CREDIT CRISIS

ANOTHER VIEW (Eng.)1

After receiving several requests to do so, I have translated my web column "Credit crisis" into English.

Politicians and financial 'experts' alike consider the lack of solvency of US mortgages to be the origin of the present crisis. I think they grossly miss the point. They fantasise, they comment on each others fantasies and by doing so only succeed in building an impressive house on sand. The real causes of the crisis, according to me, are:

-

The insane, money guzzling wars of the US.

-

The witch-hunt on drugs.

-

The ridiculously low interest rate.

-

The tax policy of the Bush administration.

-

The dawning of the truth for the Chinese.

-

The so-called innovation by banks and insurance companies.

-

The over-confident mortgage holders.

The insane, money guzzling wars of the US plus its war on drugs.

For many years US politicians and their colleagues in the rest of the industrial world, have exaggerated the dangers of terrorism and drugs. In comparison with many other dangers threatening our health and safety, those “hype” threats are negligible as figures prove. But the fight against them costs huge sums of money (and part of our freedom). In the US that money has been obtained largely by borrowing. The US budget deficit is 'astronomical'. The dominant belief is 'tax reduction'! and that is why the present administration is still popular at least with many republicans. The country is deep in debt. Thanks to blind confidence in the vitality of the US economy, this debt has been financed to a large extent by other countries, which gave credit or accommodated dollar loans notwithstanding the far too low interest paid on those loans. In comparison with the costs of the Iraqi war for example, the rescue credit, which the US Congress is currently debating is not particularly big. (this article was written at the end of September 2008). It is of the same magnitude as say 2 - 3 years worth of the costs of the Iraqi war. However, the country entertains another war in Afghanistan, a secret war in Colombia and more military operations in other parts of the world. It supports and pays for the underhand Israeli expansionist policy on Palestine territory and it builds anti-missile bases in places where there is no need, thus creating and persisting the tensions and paranoia of tomorrow.The ridiculously low interest rate and the tax cuts of the Bush administration.

The US government has been exerting pressure on the FRB to keep the interest rate low. Greenspan and his successor, Bernanke, caved in and did as they were asked with the result that the interest rate has been far too low. Bush c.s. defends this with the argument that it helps to vitalize the economy. It helps US business, that is true. The low rate puts pressure on the dollar, which has fallen against other currencies. A low dollar value helps to boost US exports.

But there is another side to the coin, about which nothing is said: -

The high prices of shares on the stock exchange. The US stocks and its effect on other parts of the word have been much too high for the last 5 years. At their peak this over rating amounted to about 50%!

-

It was not just the government that could borrow money at a low rate. Private companies benefited as well. Cheap money is good for business. And of course the general population could do the same. They made extensive use of all that credit. The US was living on credit! Citizens bought houses that were above their means, but because of the artificially low (interest on mortgages) monthly fees, that didn’t pose a problem.

-

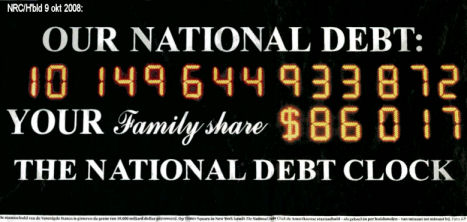

The low interest rate enabled the government to cover its expenditures by borrowing money instead of by tax. On September 24th 2008 the US national debt added up to $ 9,5 billion (9.5 x 1012). That amounts to over 30 000 dollar per US citizen. Or, on the average, each person is about one year’s worth of salary behind in his earnings.

-

All this borrowing just means gigantic money creation. Fictitious money, without real coverage resulting in the phenomenon we all know as a “bubble” economy.

Chinese are coming to their senses.

For many years other countries, especially the Chinese, gave the Americans credit. By doing so they financed their wars (!). Those foreign nations accepted the low interests they received on their loans. But now finally they are coming to their senses. They understand that the US has cheated the world and they are shifting to other currencies like the Euro. Even the old pound sterling is regaining some international currency status. For the Americans this means that their credit flow is coming to a standstill. Such a crisis is not so surprising is it?The so called innovations of banks and insurance companies.

Why not us? So the financial world discovered innovation. The wildest new 'products' have been invented and let loose on the public. They were advertised for you and me to make more money with your money. Of course they were only financial gambling constructions. A lot of money has been earned and lost with them, but the earnings went mostly to those who issued the new gimmicks, not for the people who purchased them. In that respect, there is not much difference between the gambling one finds in a casino and the world of finance. All those warrants, options, notes, futures, pass on loans and some tens of other vague vehicles with a high loss content have been invented to channel your money to other’s pockets. Funnily enough it is not only the public that has been tricked. Nowadays economists state frankly in public media, that even bankers and financial experts did not always fully understand, what they were (!). (Lex Hoogduin2 & Paulson, VS Min.of. Fin3) I’ve been sceptical for many years about these investment structures that have been designed to tap the money from the public and place it into the hands of the financial wiz kids. The list of mutual funds etc. in our newspapers is much longer than the list of real companies in which they invest!The over-confident mortgagees.

Finally we have the mortgagees, who have been misguided by the wrong policy of their own government and by the irresponsible advice of their financial wizards to accept such high levels of loans.This is the crisis in a nutshell and but only the people previously mentioned are being blamed.

At the time of writing of this text, there is a stormy debate in the US Congress about an emergency plan to cope with the crisis. It involves $ 700 billion (7 x 1011). The federal government intends to use these funds to buy up dubious loans from banks and insurance companies in order to help them continue trading. Mr. Bernanke has already mentioned that even this amount is perhaps not enough. "We might come back later, to ask for more." (1) More serious than the actual amount, is that the US government, with its appalling budget deficit, does not have the money! It has to borrow it. So, a deep hole has to be dug, to fill the other hole. This is not a remedy though; it is just shifting the problem aside instead of solving it. It could even increase the already dizzying high national debt. It will certainly raise the interest rate. As a bemused spectator from across the ocean, I might hazard a guess that financial magicians will begin to ask for a lowering of the interest rate! That would deepen the crisis.

Robeco

(Added after the first appearance of this column on 2008 09 27.)

Arnold Verruijt pointed my attention to an article by B. Zevenbergen in the Dutch Financial Daily. It appeared the day after this one on the Internet. Perhaps it was my somewhat unfriendly comment in footnote (1) about this big Dutch mutual funds provider and its chief economist, Lex Hoogduin, that led Verruijt to mention this paper to me. FD 25 sep.

Zevenbergen writes that Robeco bought a very substantial amount of shares in these now-bankrupt companies just before their collapse. Oops! What kind of financial experts do they employ! Those who know me well, know that I’m a generous individual. It wouldn’t be like me at all to single out Robeco or its chief economist as the only ones to whom I would bestow such ridicule. They are far from alone. My advice to you all is to avoid the particular species of financial advisers, and the hit-and-run circuit of mutual funds, hedge funds and other so-called financial wizards, like the plague. Unless of course you want to lose all your savings.1) Peter Koeze drew my attention to the wars and the low interest rate as the real causes of the current crisis. We were discussing an interview with Prof. Hoogduin at the time. See below. He is the chief economist of Robeco. Robeco is one of the biggest Dutch fund corporations. It tried constantly to convince the public to step into a stock market that was already highly over sold. Hoogduin gave a series of explanations in hindsight. He warns against 'measuring' and 'computing'. Herein lies the cause of all our troubles, he says. I would say: Wrong, professor!. The problem is erroneous computing and faulty measuring!

2) NRC/H'bld "Saturday September 20 2008.

3) NRC/H'bld September 24 2008, p. 1.

Original (in Dutch) Nieuwegein, 2008 09 24.

2008 09 27

Pic added 2008 10 09.